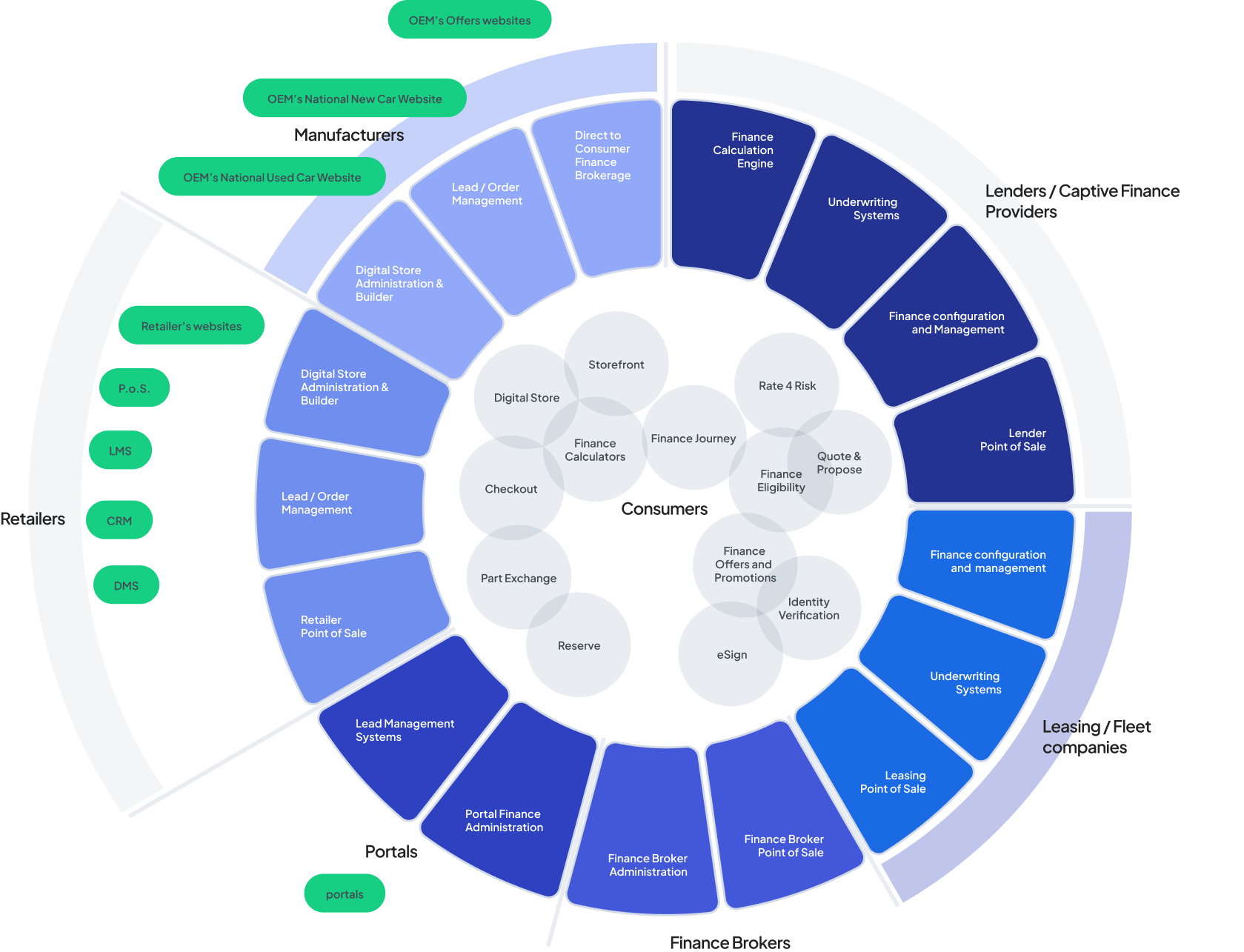

Automotive Finance Solutions

A single modular platform to create, manage and offer consumers and businesses your finance products across multiple channels and markets.

Finance Point of Sale (P.o.S) | Inventory Management | Finance Applications | Underwriting system | Soft credit checks | e-signature capabilities | Identity Verification (ID&V) | Multi-Market Calculation Engine | Quote and Propose | Broker Point of Sale (P.o.S) | Fleet Point of Sale (P.o.S) | Finance pre-approval | Dynamic Consumer Finance Journey | and much more

Customise Your Digital Offering With a Modular, Flexible Platform.

Adopt a complete solution or select only the features you need, with effortless integrations into your existing systems.

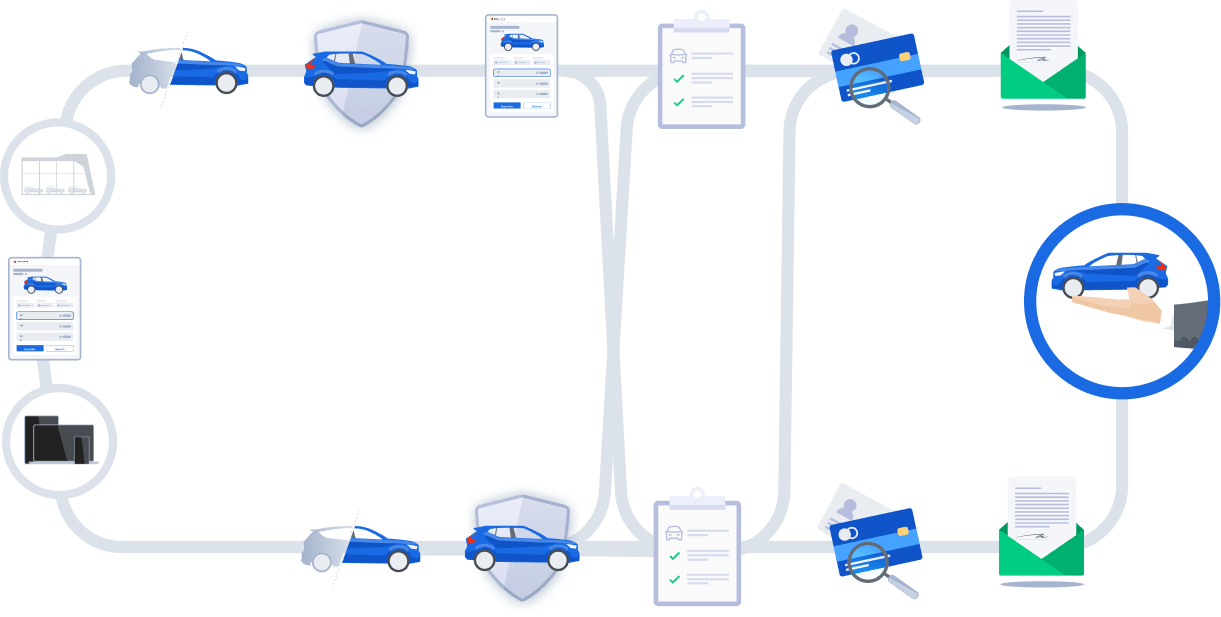

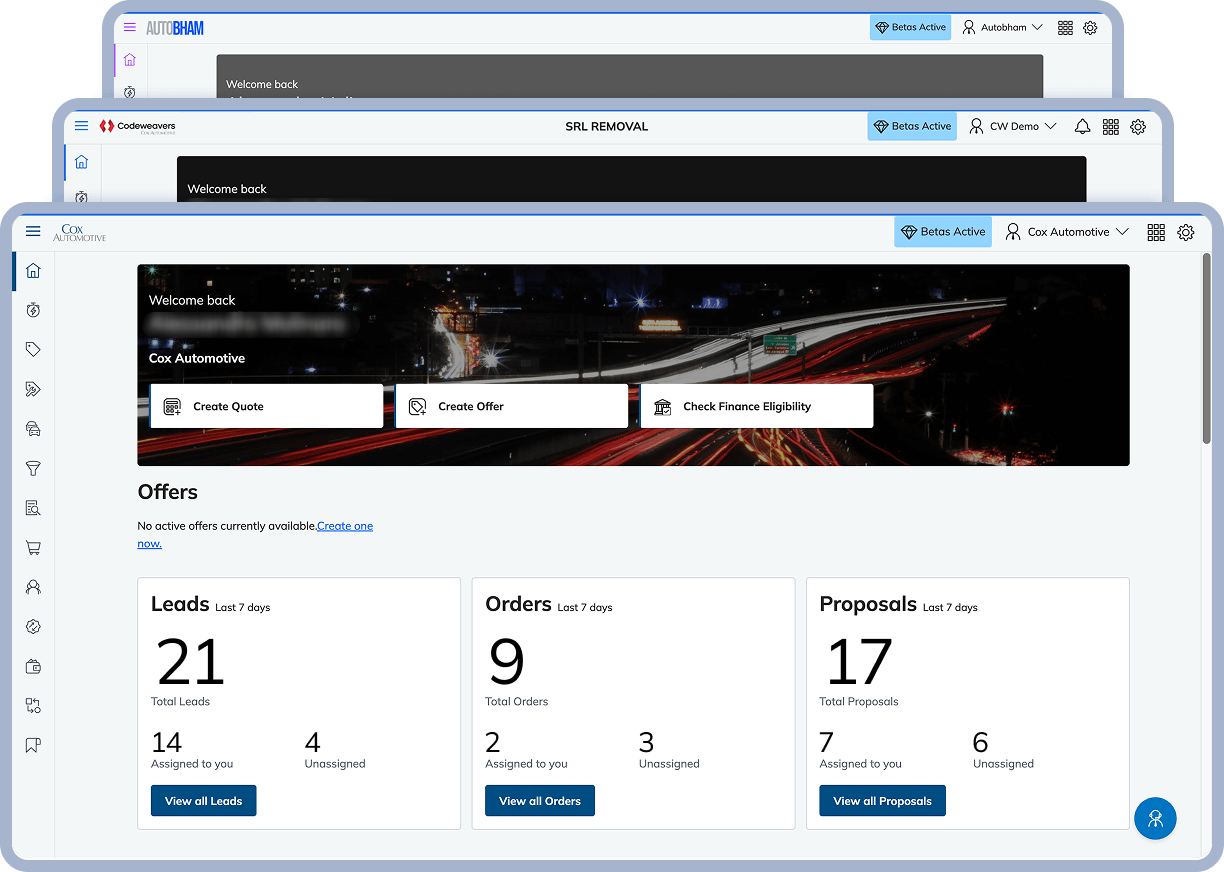

A connected, omnichannel finance journey.

Offer a seamless transition between online and in-store interactions, minimise drop-offs and enable faster decision making.

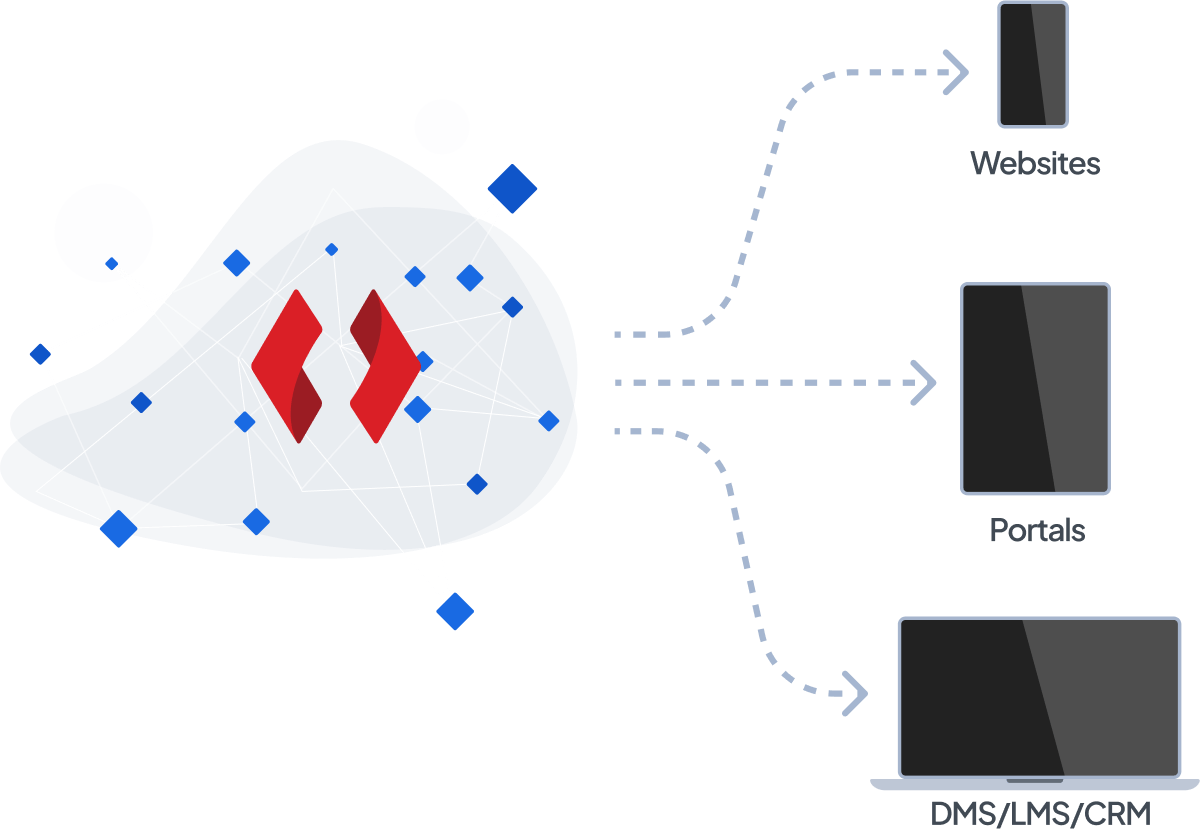

Effortless finance integrations across every sales channel.

Integrate finance calculations across all sales channels, including national websites, retailer websites, point-of-sale systems, and portals.

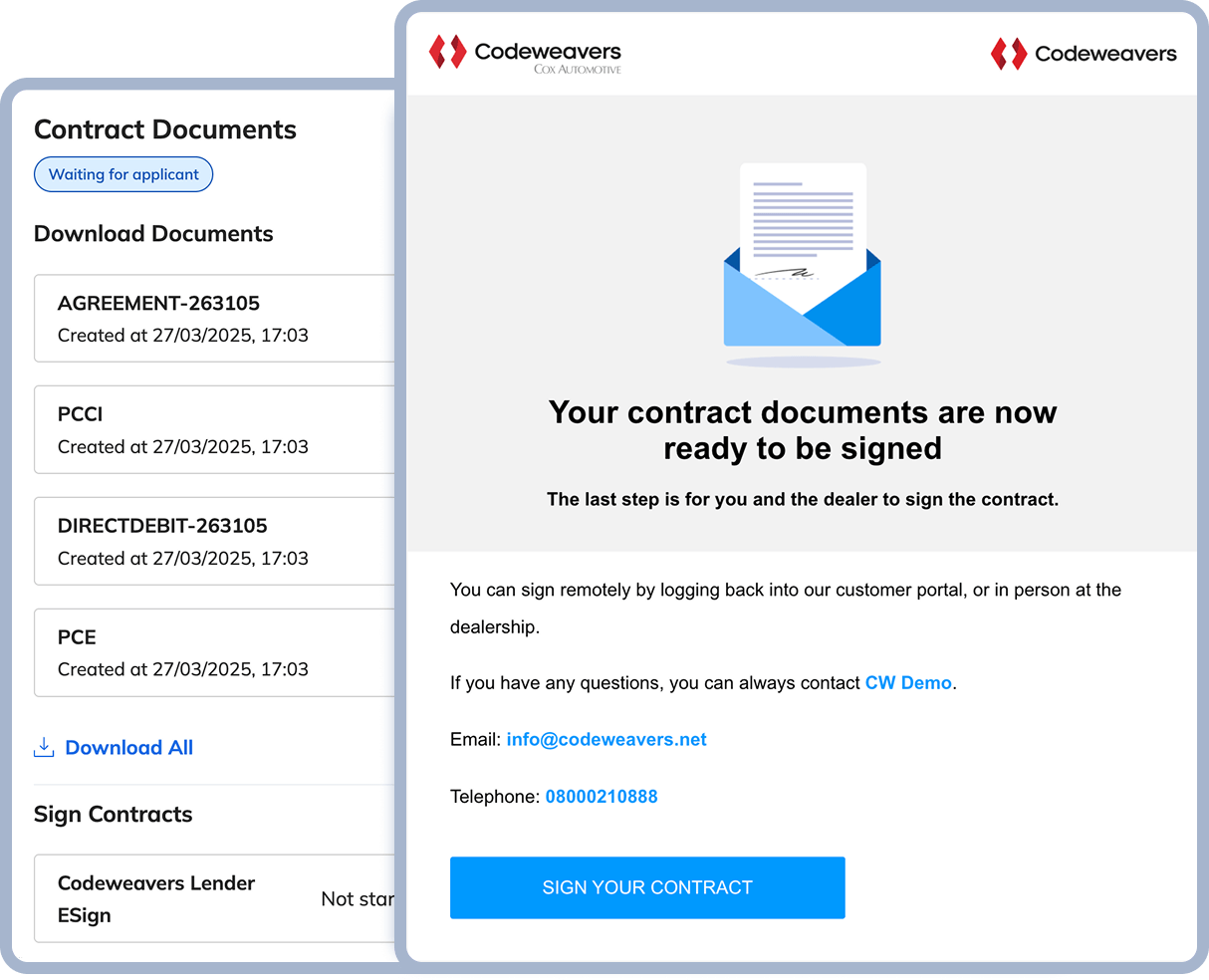

Enhance your business efficiency with a paperless operation.

Reduce the reliance on paper records, minimise manual errors and enable lenders to harness the power of real-time data capture.

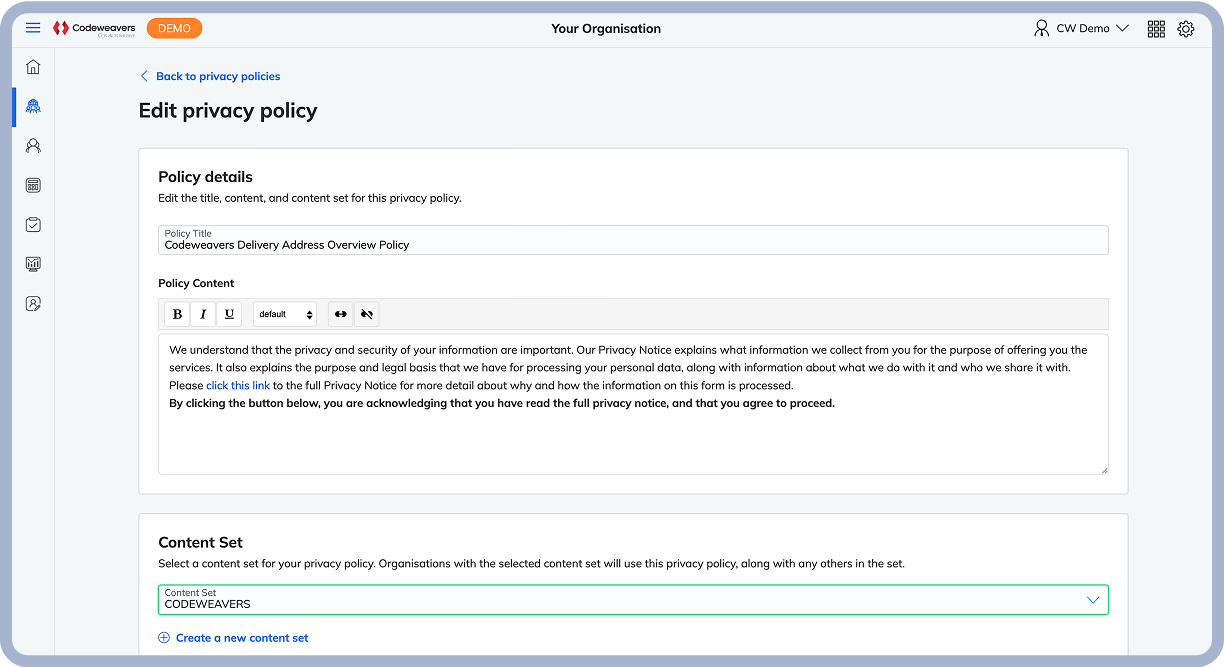

Constant evolution and compliance-first solutions.

We handle all localisation, compliance requirements and continuously update our platform, avoiding long update cycles and enabling us to respond swiftly to industry changes.

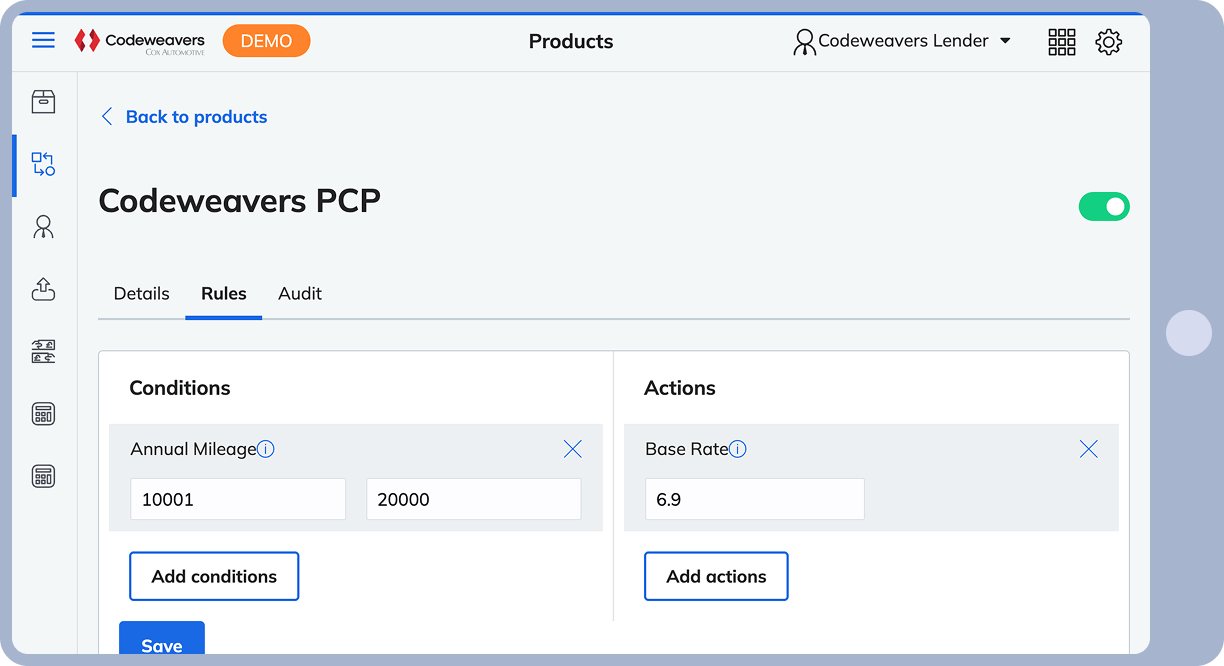

Provide accurate, real-time quotes and reduce the number of declined applications.

Our instant calculations and quotes are powered by lender rates rather than representatives or ads, delivering better-quality leads and higher first-time acceptance rates.

Create and manage your finance products, with complete autonomy.

Effortlessly manage commissions, residuals, finance rates, APRs, and product rules without external support, for increased efficiency and control.

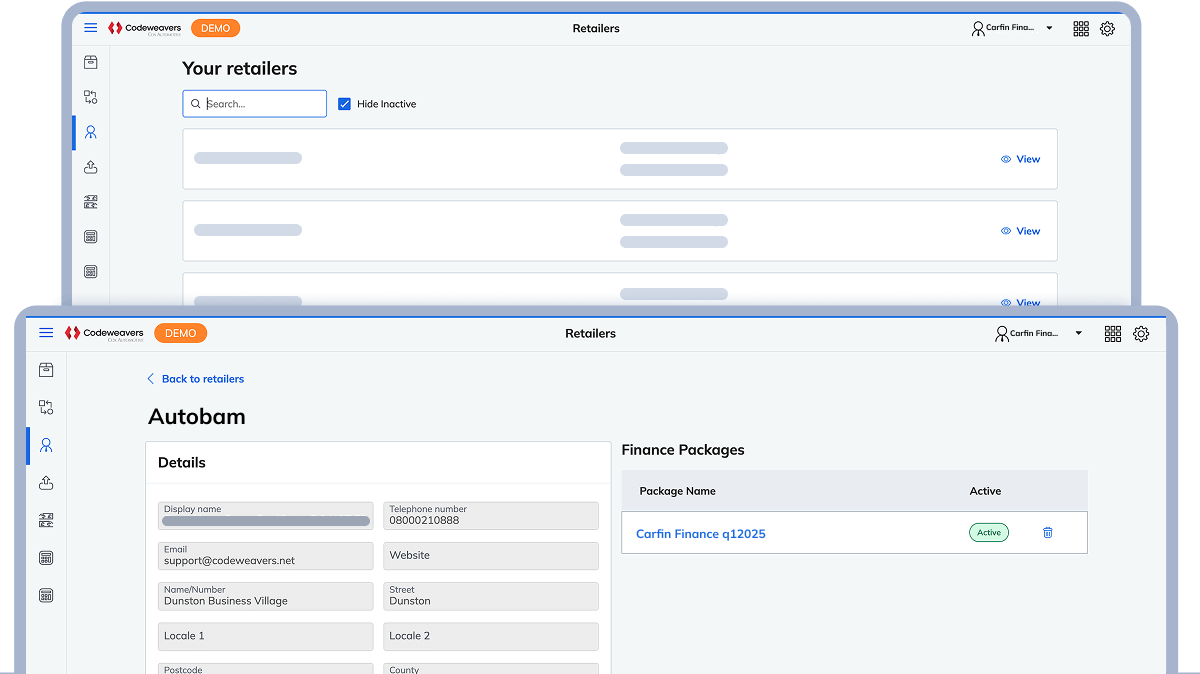

Instantly surface finance across your retailer network and beyond.

Deliver real-time calculations to anyone selling products on your behalf, with seamless accuracy between you, your Point of Sale, and your customers.

Provide your network with a complete Point of Sale to sell your finance.

Our Point of Sale allows your network to explore, manage, and submit finance applications with customers directly to you for underwriting.

Showcase a consistent, trustworthy journey.

Tailor your offering with your branding guidelines, images and logos for a streamlined and consistent journey that builds customer confidence.

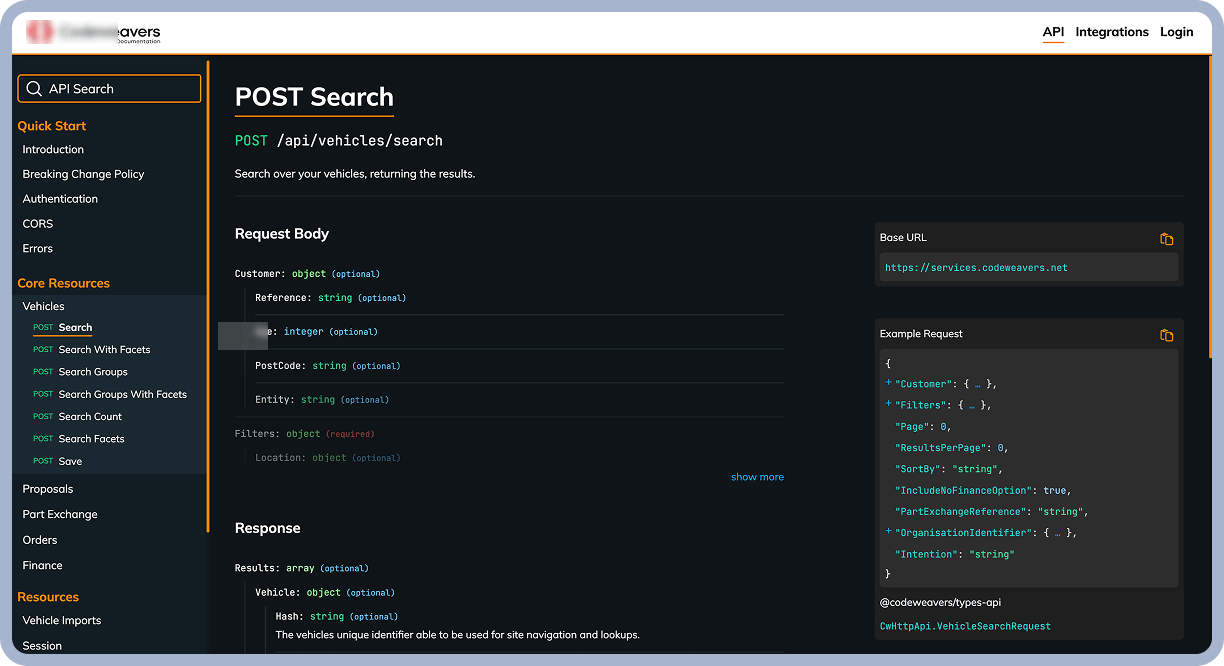

Choose your setup: a fully built-out front end, plug-and-play components, or API-only integration to power your existing solution.

Upgrade your offering fast with our powerful APIs.

Our suite of APIs allows you to quickly build a customised omnichannel experience that adapts to the unique requirements of different markets and demands.